Research That Actually Makes Sense

Financial research doesn't need to be intimidating. Our program walks you through practical methods that work in real Australian markets—techniques you can apply whether you're analysing small businesses or tracking industry trends.

Starting February 2026, we're running a structured 8-month program designed for people who want to understand the numbers behind business decisions. No fluff, just solid research frameworks you'll use again and again.

Talk to Us About Enrolment

How We Actually Teach This Stuff

We've spent years watching people struggle with research methods that sound impressive but fall apart in practice. So we built something different—three core tracks that connect theory to the messy reality of financial analysis.

Quantitative Foundations

Numbers tell stories, but only if you ask the right questions. We start with data collection that doesn't take forever, then move into statistical methods that actually reveal patterns.

- Survey design for financial contexts

- Regression analysis without the headaches

- Time series work for market behaviour

- Building datasets that hold up under scrutiny

Qualitative Approaches

Sometimes the best insights come from conversations and careful observation. We teach you how to conduct interviews that uncover what people actually think about financial decisions.

- Interview techniques for business contexts

- Case study development from ground up

- Thematic analysis that finds real themes

- Documentation that captures nuance

Mixed Method Integration

The best research often combines approaches. We show you how to blend quantitative rigour with qualitative depth—because real financial questions rarely fit into one box.

- Combining surveys with follow-up interviews

- Triangulation strategies that work

- Sequential and concurrent designs

- Writing up complex findings clearly

| Research Component | What You'll Learn | Real Application | Duration |

|---|---|---|---|

| Literature Review Mastery | Finding and synthesising relevant research without drowning in papers | Building evidence base for market analysis reports | 6 weeks |

| Data Collection Design | Creating instruments that get you usable information the first time | Customer behaviour studies, risk assessment surveys | 8 weeks |

| Analysis Techniques | Statistical and thematic tools you'll actually use beyond the course | Investment pattern analysis, client interview insights | 10 weeks |

| Ethics and Integrity | Navigating consent, confidentiality, and responsible reporting | Protecting participant data in financial contexts | 4 weeks |

| Independent Project | Your own research from question to final report with our guidance | Portfolio piece showing your methodology skills | 12 weeks |

Who's Actually Teaching

Our instructors have done the research, published the papers, and—most importantly—survived the frustrating parts. They know where students get stuck because they've been there themselves.

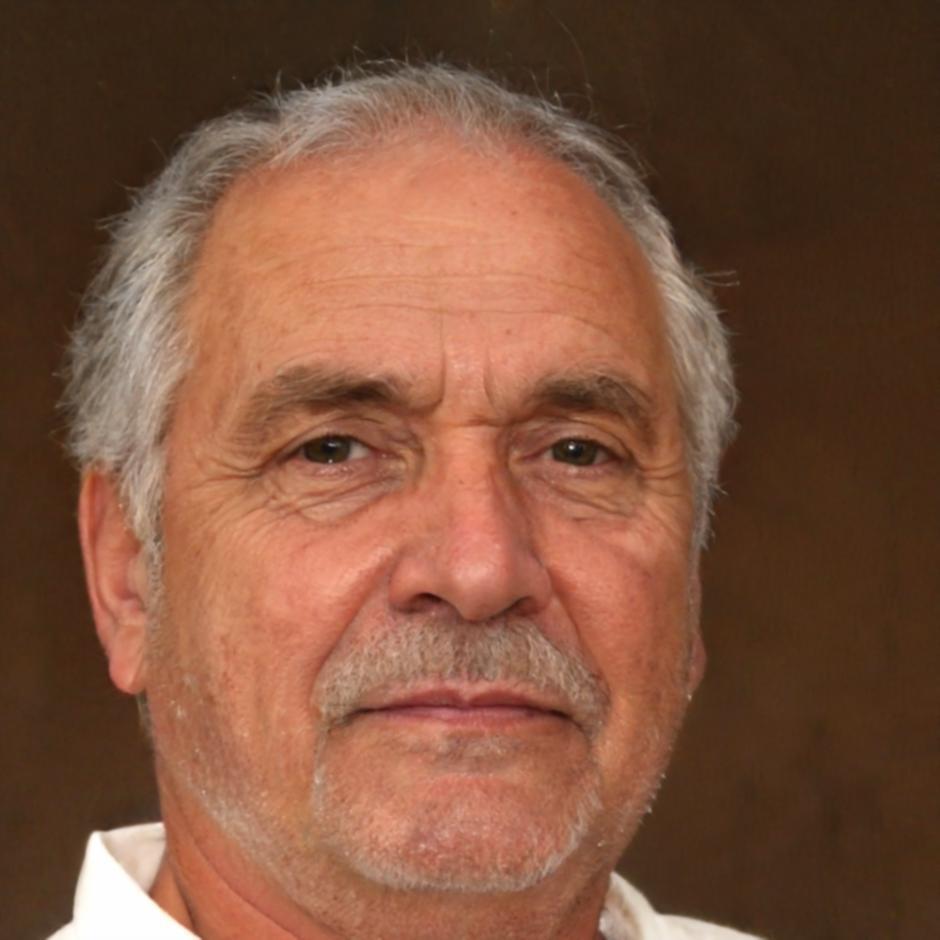

Torben Lindqvist

Quantitative MethodsSpent 12 years analysing market data for mid-sized firms before moving into education. Still consults on research design for financial institutions.

- PhD, Financial Economics

- Published in Journal of Business Research

- Former analyst, Commonwealth Bank

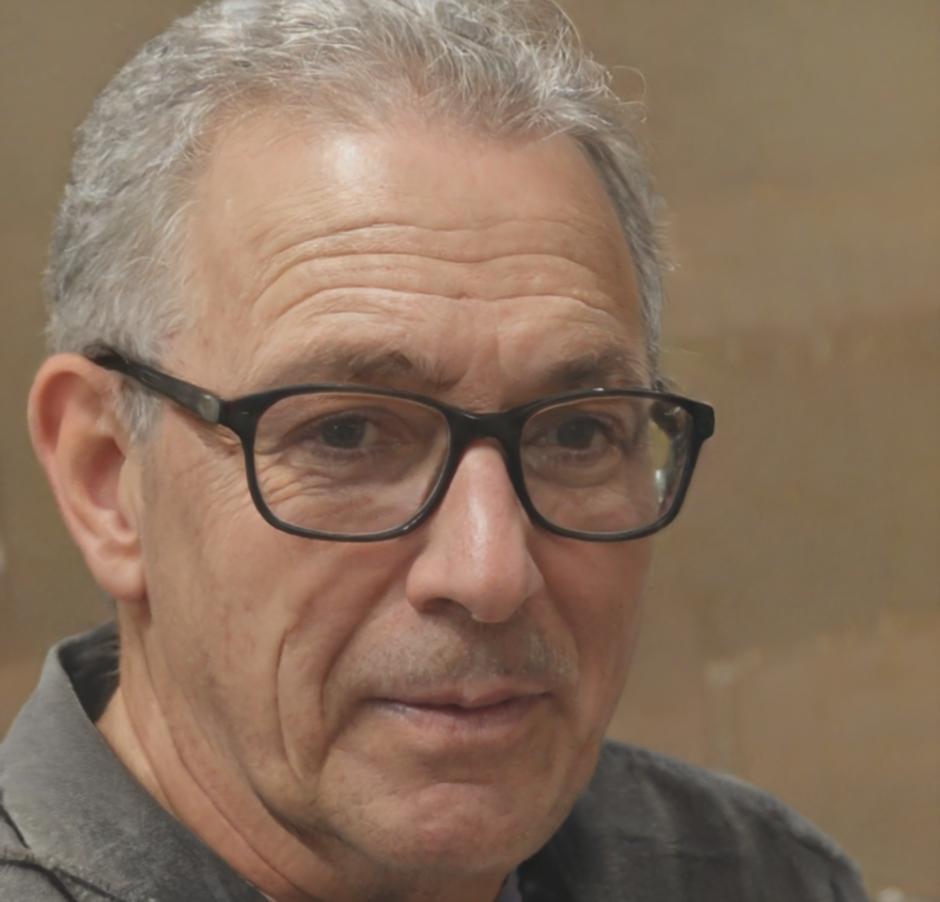

Henrik Voss

Qualitative ResearchRuns the qualitative methods stream. His background in organisational behaviour brings a human perspective to financial research.

- Master of Research Psychology

- 15+ years interviewing business owners

- Specialist in case study methodology

Aleksander Petrenko

Mixed MethodsBridges the gap between numbers and narratives. His own research combines statistical analysis with in-depth interviews to understand investor decision-making.

- PhD candidate, Financial Behaviour

- Research consultant for ASX firms

- Published work on retail investors

Daan Verschuren

Research EthicsHandles our ethics and research integrity modules. Former compliance officer who knows how important it is to do research responsibly in financial contexts.

- Graduate Certificate, Research Ethics

- 10 years in financial compliance

- Ethics committee experience